From Black Friday to Christmas, Australian retailers face their most critical sales window of the year. This season, global trade volatility, domestic distribution challenges and last-mile delivery risks are converging to test every link in the supply chain. Here’s how retailers can prepare and protect their customer promise.

Every year, the Australian retail calendar builds to a high-stakes crescendo. Black Friday, Cyber Monday and the weeks leading up to Christmas are now the busiest trading period for merchants, surpassing the Boxing Day sales that once dominated.

Nick Aiello, NTI’s National Product Manager - Cargo and Carriers, says retailers are entering this season against one of the most challenging backdrops in memory. “It’s a highly dynamic and volatile environment,” he says. “It’s probably one of the most complex global trade environments we’ve ever seen.”

Geopolitical flashpoints, from Russia and Ukraine to conflict in the Red Sea, continue to disrupt shipping routes. Inflation remains above the long-term average, and rising tariffs are squeezing margins, while port delays, container shortages and even local flooding have added further uncertainty.

These forces set the stage for a peak season where preparation, timing and execution matter more than ever.

Key takeaways

Peak season is bigger and starting earlier than ever. Black Friday and Cyber Monday have overtaken Boxing Day as Australia’s biggest retail events, generating $2.2 billion in 2024 online sales and driving a 12 per cent year-on-year lift in e-commerce. For retailers, that means competition is fierce and timing is critical.

Congestion increases exposure. Longer vessel wait times at major ports can cause shipments to be consolidated, pushing cargo values above planned cover limits. Retailers need to ensure policies are adequate heading into peak season.

Weigh storage costs against surcharges. Peak season freight adds US$250-500 per container. Retailers leasing space from 3PL (third-party logistics) providers often prefer to pay the surcharge to keep stock moving, while those with their own warehousing capacity may build supply in early to avoid the extra cost.

Outsourcing eases pressure, but reduces control. Turning to 3PLs can relieve warehouse and distribution strain, yet it comes with trade-offs in visibility, responsiveness and cyber risk. Retailers need to weigh short-term efficiency against the longer-term value of keeping capacity in-house.

Protect the last mile to protect the brand. Customers are unforgiving of delivery failures, with 64% abandoning a retailer after a poor experience. Cargo cover protects freight in transit, but delivery protection is just as vital to secure the last mile, resolve disputes quickly and safeguard customer trust.

Understanding peak season in Australia

The significance of the peak sales window for retailers can’t be overstated. From late November through to the end of December, trading volumes surge to levels unseen at any other point in the year.

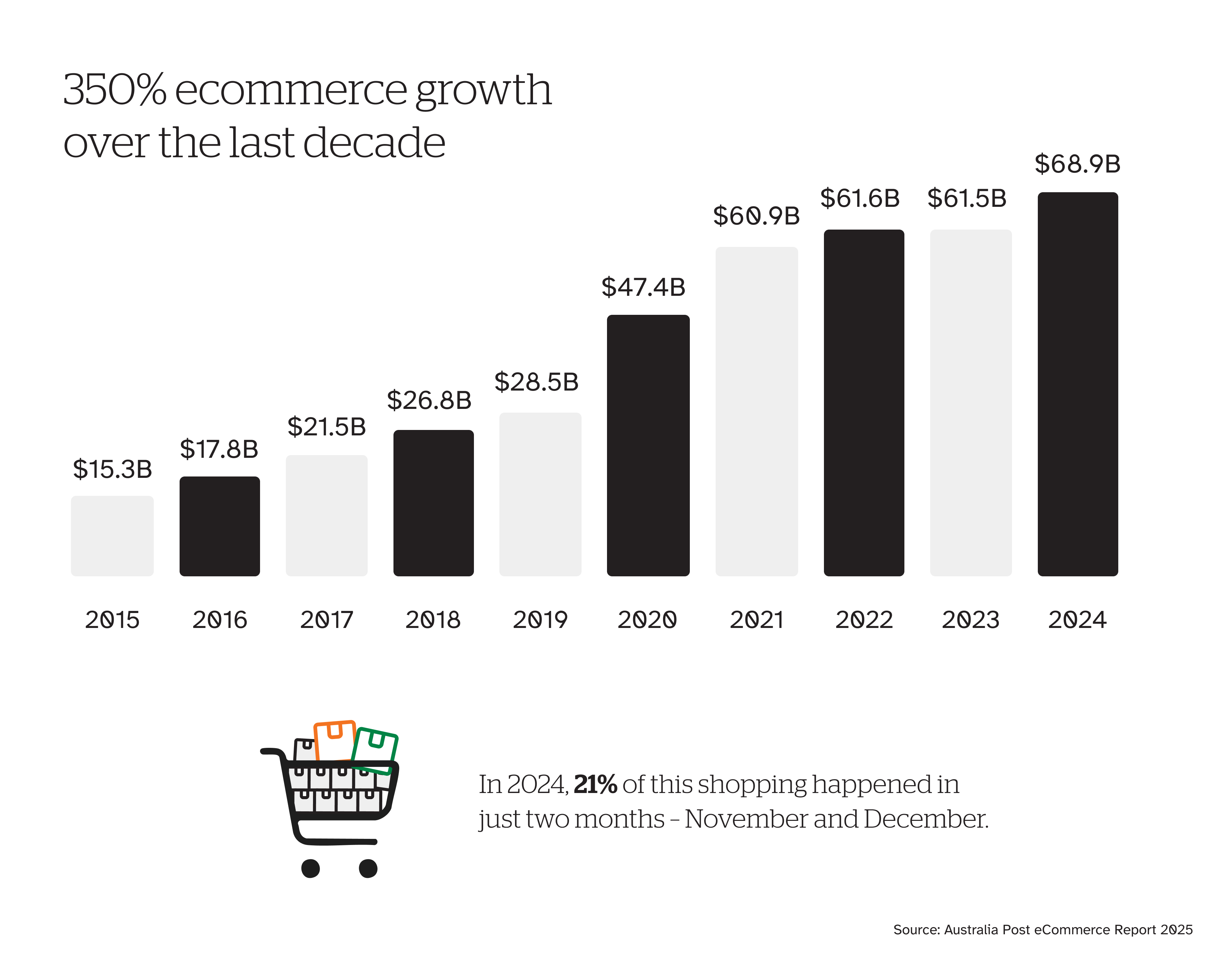

In 2024, Black Friday and Cyber Monday (BFCM) generated $2.2 billion in online sales, a 10 per cent increase in spend on the year before, while orders were up 15 per cent year-on-year in volume. Australia Post reported moving more than 100 million parcels in the lead-up to Christmas, and during the four days of BFCM, daily volumes were roughly double those of the Christmas-New Year period.

Across the year, Australia Post reports the nation spent $69 billion online, up 12 per cent, with peak season a key driver of that growth. November spend alone has grown fivefold since 2015, while December is now more than four times higher.

Sales momentum now starts with Click Frenzy in October, accelerates through Singles Day in early November – a Chinese shopping holiday that has spread globally through platforms like Shein and Temu – and peaks across BFCM and Christmas before rolling into New Year’s sales.

Nick says this means two things for retailers. “Firstly, competition to capture attention is more fierce than ever. And secondly, getting stock in place on time is absolutely critical. For us, it reinforces the need to help businesses manage their logistics so goods are where they need to be, when they need to be there.”

Plan for delays and check your cover

For many retailers, the biggest challenges of peak season begin long before stock reaches Australian shores. The sheer volume of goods moving through global networks in the lead-up to Christmas creates pressure points that can delay shipments, drive up costs and leave businesses scrambling to meet demand.

Chelsea Neely, NTI’s Logistics Risk Engineer, says congestion at major trans-shipment hubs is a recurring problem. “Singapore is a key hub, and vessels usually wait two to three days to berth,” she says. “During peak season that can stretch to six days. A retailer might send a shipment on Monday, only to find it delayed almost a week, then joined by another consignment. Suddenly they’ve got double the cargo on one vessel, which is more than they’d planned to insure.”

Nick notes that cargo policies generally contain clauses to account for this, but retailers need to be proactive. “If cargo ends up consolidated unexpectedly, policies provide automatic protection,” he explains. “But if you plan to ship multiple containers together, you need to update your policy limits to cover the total value. It’s critical to make sure those limits are adequate heading into peak season.”

Retailers can’t eliminate congestion, but they can plan around it by building extra lead time into shipments or diversifying suppliers. Each option carries costs or compromises, but thinking them through early can help avoid being caught off guard.

Weigh storage costs against surcharges

Surcharges are another factor retailers must navigate. Chelsea explains: “Many shipping lines add a peak season surcharge, which is typically about US$250 on a 20-foot container and US$500 on a 40-foot container. Retailers have to weigh up whether to bring product in earlier and pay for storage, or accept the higher freight bill.”

For retailers reliant on offshore supply chains, these decisions have major financial implications. Bringing stock in too early ties up cash flow in storage; waiting too long risks missing the sales window altogether.

Chelsea notes that businesses leasing space from third-party logistics providers (3PLs) often prefer to pay the surcharge to keep stock moving, while those with their own warehousing capacity may choose to build supply in advance to avoid the extra cost. Whichever route retailers take, forward planning ensures the decision supports both cash flow and customer demand.

Know the limits of outsourcing

Infrastructure capacity is another looming challenge. CBRE analysis suggests every additional $1 billion in online sales requires 70,000 square metres of logistics space. At current growth rates, between 1.7 and 1.8 million square metres of additional capacity will be needed by 2030.

Chelsea notes that many businesses are already turning to 3PLs to consolidate cargo and manage distribution. “Outsourcing has benefits, but it also reduces control,” she cautions. “Retailers lose visibility of IT systems and can’t always prioritise urgent cargo. Cyber risk is also a concern. A breach at a 3PL can disrupt multiple businesses at once.”

For retailers, outsourcing is rarely a simple decision. It can relieve pressure on space and resources, but it also means relying on external systems and processes at a time when visibility, security and responsiveness are critical. The challenge is weighing up short-term efficiency against the longer-term need for control, and deciding where additional in-house capacity might be worth the investment.

Protect the last mile

If the international and domestic legs of the supply chain are challenging, the last mile is where pressure peaks. Bert Webster, NTI’s National Development Manager - Distribution, says consumer expectations are rising sharply, reshaped by global eCommerce giants such as Amazon, and delivery is now “part of the value promise”.

The stakes are high. Australia Post reports 64 per cent of Australian shoppers will abandon a retailer after a poor delivery experience, while research from Shippit shows 85 per cent say reliable delivery is the single most important factor in trusting an online store. For retailers, one failed delivery can mean losing a customer altogether, and damaging brand reputation in the process.

That risk is compounded by consumer law, which puts responsibility on the merchant, not the courier. “The old days of sending customers to queue at the post office are gone,” Bert says. “Our research shows 81 per cent of customers will go straight back to the retailer when something goes wrong.” That leaves retailers exposed to everything from delays to theft. Porch piracy alone affects an estimated four million Australians, with the merchant left to foot the bill.

Cover the whole journey

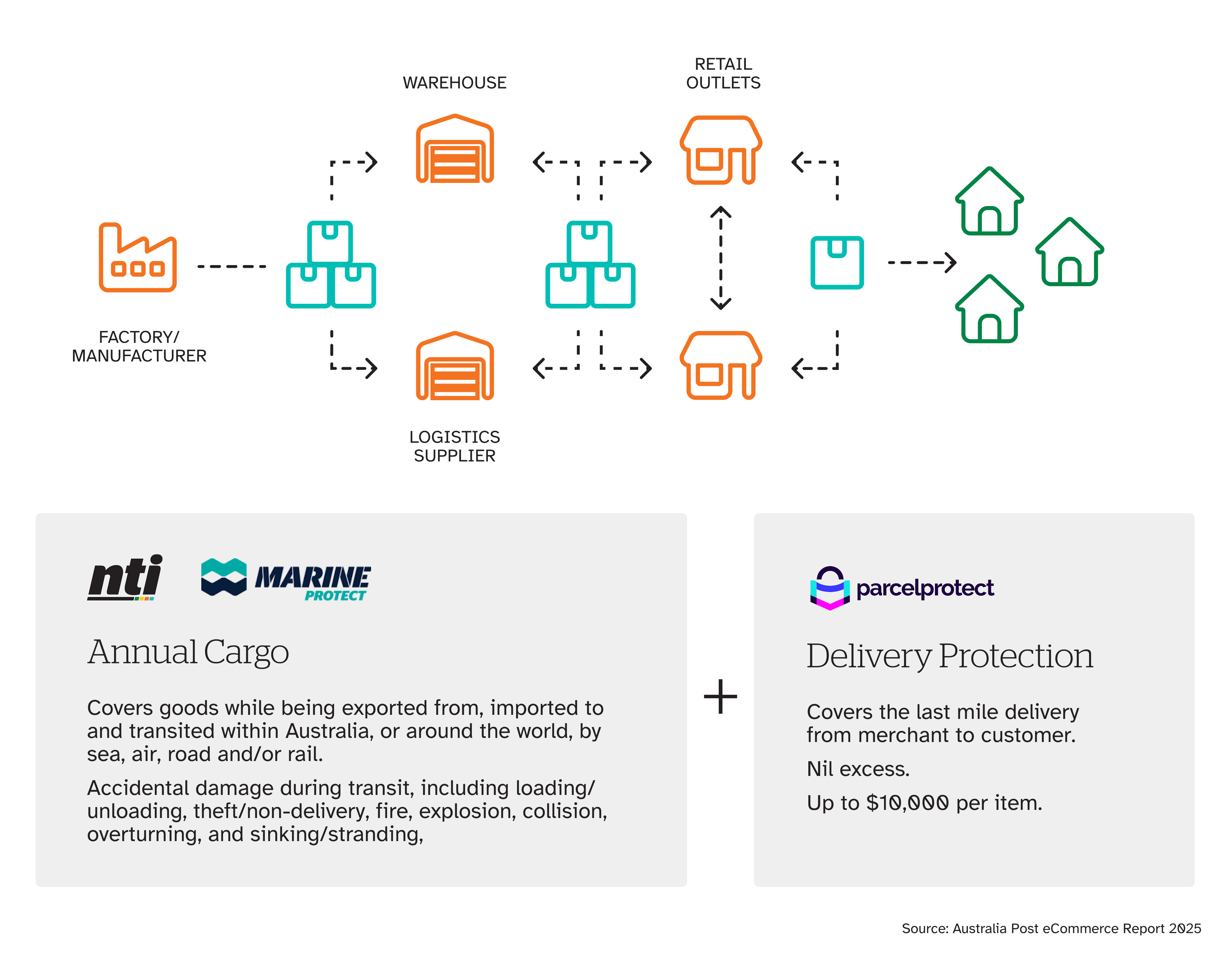

The pressures of peak season highlight just how vulnerable supply chains can be. It’s not only about keeping goods moving, but also protecting them from damage, theft and failed deliveries. That requires two layers of cover – cargo insurance for freight movements, and delivery protection for the last mile.

Cargo insurance covers goods while they’re moving between countries, between warehouses, or around Australia, whether by sea, air, road or rail. It protects against accidental damage in transit, theft, non-delivery, fire, collision or overturning. For bulk shipments and higher-value consignments, cargo insurance is the foundation of protection.

But, as Nick points out, these policies are built for peak exposures and large shipments, not the low-value, high-frequency deliveries that dominate eCommerce. That’s where delivery protection comes in. NTI’s Parcel Protect solution bridges the gap, covering the last mile from merchant to customer. Integrated directly into merchant platforms, it allows claims to be lodged and resolved quickly, reducing disputes and protecting customer trust.

For Nick, the value goes beyond financial cover. “It strengthens the retailer’s brand promise,” he says. “By resolving disputes quickly and transparently, retailers can protect customer relationships and avoid the reputational damage of failed deliveries. Combined with our cargo cover, it creates end-to-end protection, from the factory floor to the customer’s doorstep.”

Together, cargo cover and Parcel Protect form a complete shield for retailers: cargo insurance protects imports, exports and warehouse transfers, while delivery protection secures the last mile to the customer. Having both in place ensures confidence at every stage of the journey.

Peak season will always test the supply chain, but it’s also when the customer promise matters most. Retailers that prepare early, manage risks across every stage of the journey and respond quickly when issues arise are better placed to protect trust and avoid reputational damage.

That’s when the season becomes more than just a sales spike. It’s a chance to build loyalty that lasts long after the rush has passed, and set retailers up for success in the year ahead.

Limits and exclusions apply. This information is general only and does not take into account your objectives, financial situation or needs. When making decisions about our insurance, consider the Product Disclosure Statement and Target Market Determinations on www.nti.com.,au. Insurance products are provided by National Transport Insurance, a joint venture of the insurers CGU Australia Pty Ltd trading as CGU Insurance ABN 62 004 478 960 AFSL 700014 and AAI Limited trading as Vero Insurance ABN 48 005 297 807 AFSL 230859 each holding a 50% share. National Transport Insurance is administered on behalf of the insurers by its manager NTI Limited ABN 84 000 746 109 AFSL 237246.