Sea Change: What Five Years of Marine Claims Trends Reveal About Global Supply Chains

Over the past five years, the global supply chain has rarely been out of the headlines. For retailers moving goods across oceans, the period has been defined by disruption, uncertainty and constant change.

What began with the shock of COVID quickly gave way to a rolling series of challenges: geopolitical conflict, port congestion, vessel rerouting, longer voyages, shifting loss patterns and increasingly organised theft.

NTI’s marine team have had a unique vantage point throughout this turbulence. Handling thousands of claims across the full span of the supply chain has highlighted not just where risks are emerging, but how retailers can adapt to stay resilient. The lessons from those claims are shaping how we support brokers and their clients today.

Key takeaways

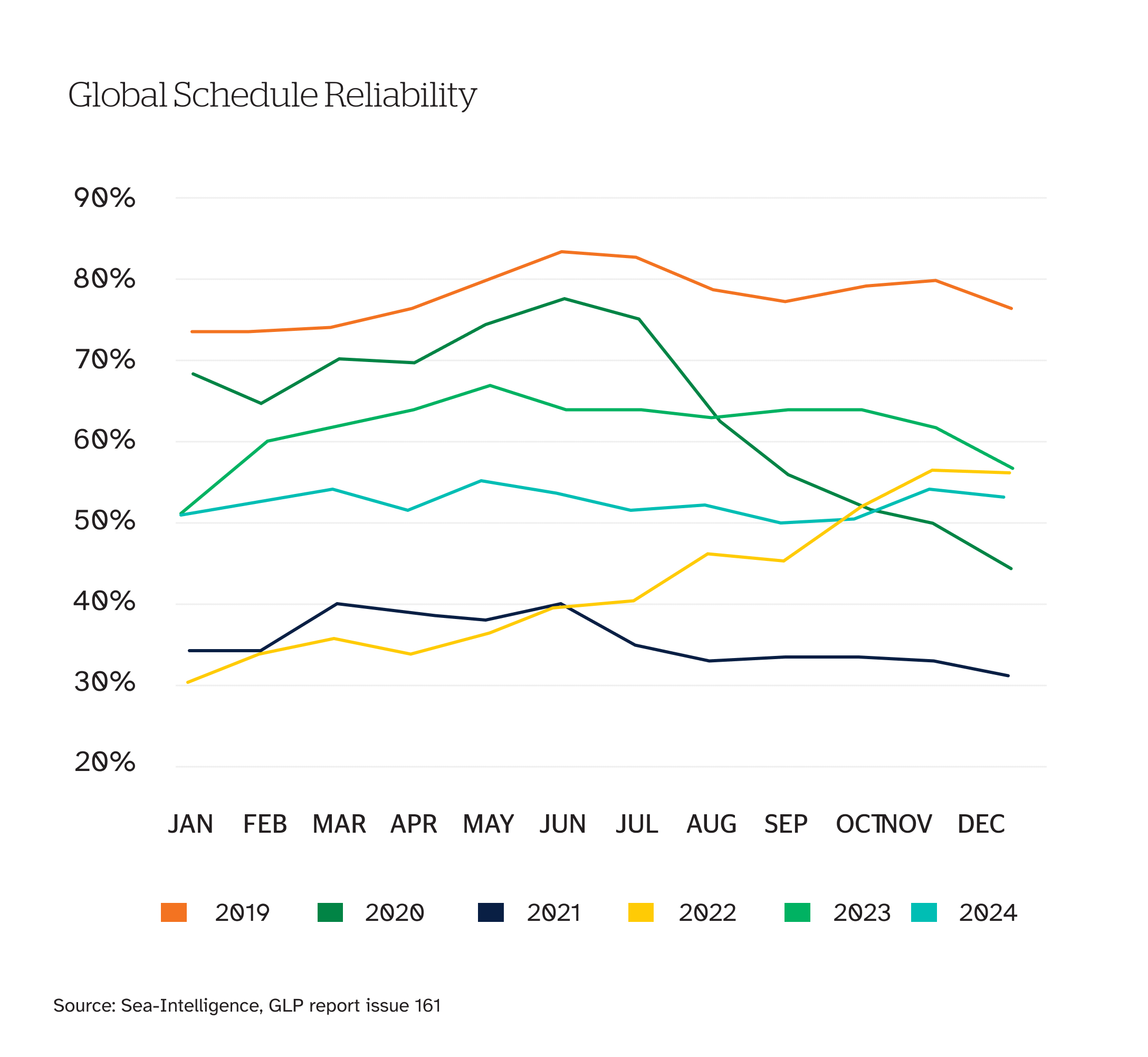

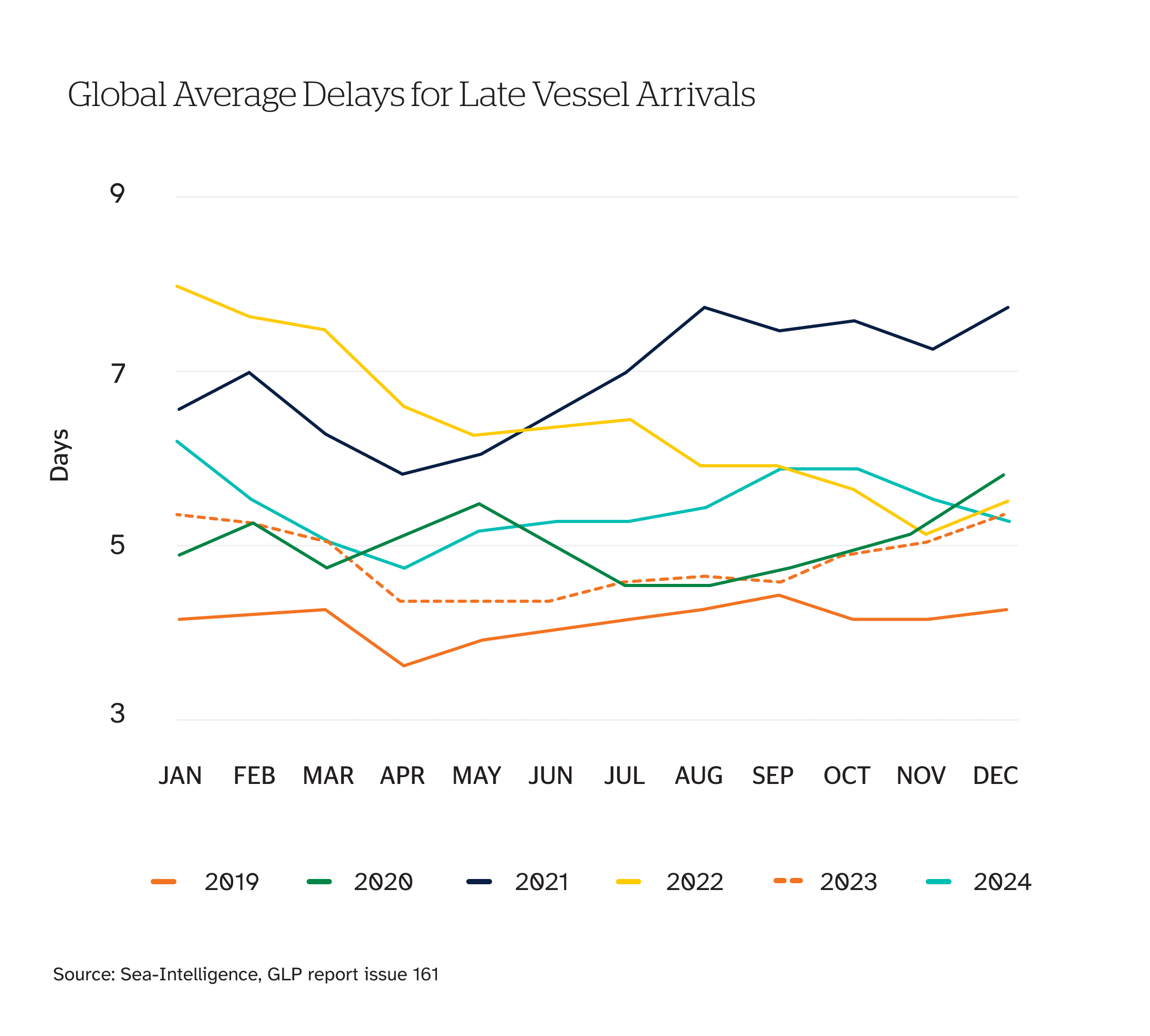

Disruption is constant. From COVID shocks to conflicts and congestion, global supply chains face ongoing volatility that has reshaped how goods move. Global schedule reliability still lags behind pre-COVID benchmarks, averaging just 50-55 per cent through 2024 compared with ~75-80 per cent in 2019*. Delays for late vessels are also running higher, at 5-6 days on average versus around 4 days before the pandemic*.

Longer voyages mean higher risk. Vessel rerouting and canal restrictions have extended voyage times, driving a rise in water damage claims and an increase in temperature-control failures.

Cargo theft is escalating. Organised groups are targeting shipments globally and they’re becoming increasingly tech savvy and sophisticated. Theft incidents have risen significantly in recent years; between 2024 and 2025 alone, NTI recorded a 10 per cent increase in theft claims.

Resilience is the new priority. Retailers are diversifying suppliers, holding more buffer stock and strengthening packaging to adapt to tougher conditions. One importer cut its claim frequency in half after working with NTI to redesign its packaging.

NTI turns claims into insights. By analysing thousands of losses and sharing risk engineering advice, NTI is helping businesses strengthen operations, reduce claims and protect margins.

Change is the new normal

When the pandemic hit, “supply chain” became a household phrase. What had once been industry jargon was suddenly part of everyday conversation, as empty shelves and delivery delays made the fragility of global trade visible to consumers.

COVID exposed the vulnerabilities of just-in-time supply chains. With borders closed and freight routes clogged, retailers relying on lean inventory often couldn’t meet demand. Many have since shifted to a just-in-case approach, holding more stock, diversifying suppliers and spreading risk across regions. India, for example, is emerging as a key partner alongside China.

The pandemic also accelerated online shopping, which changed the nature of claims. Instead of just container loads, NTI began handling surging parcel volumes, and seeing how small packaging missteps could cause big problems.

A well-intentioned trend of wrapping expensive goods in black plastic to hide their value, for instance, meant scanners couldn’t read the barcodes. Parcels went missing in high-volume networks, or overheated when left in the sun.

NTI’s risk engineers have helped retailers adapt by improving packaging and labelling practices, ensuring parcels can be scanned, tracked and withstand tougher handling conditions.

NTI’s Parcel Protect system connects directly with retailers’ order platforms, giving instant visibility of the goods, value and journey. That allows claims teams to bypass paperwork and resolve issues in minutes, keeping deliveries moving, protecting margins, and maintaining customer trust.

Longer voyages, higher stakes

COVID may have been the initial shock, but the pressures on supply chains haven’t eased since. Geopolitical conflicts, shifting trade routes and congestion at ports continue to extend voyage times and increase risks for cargo owners.

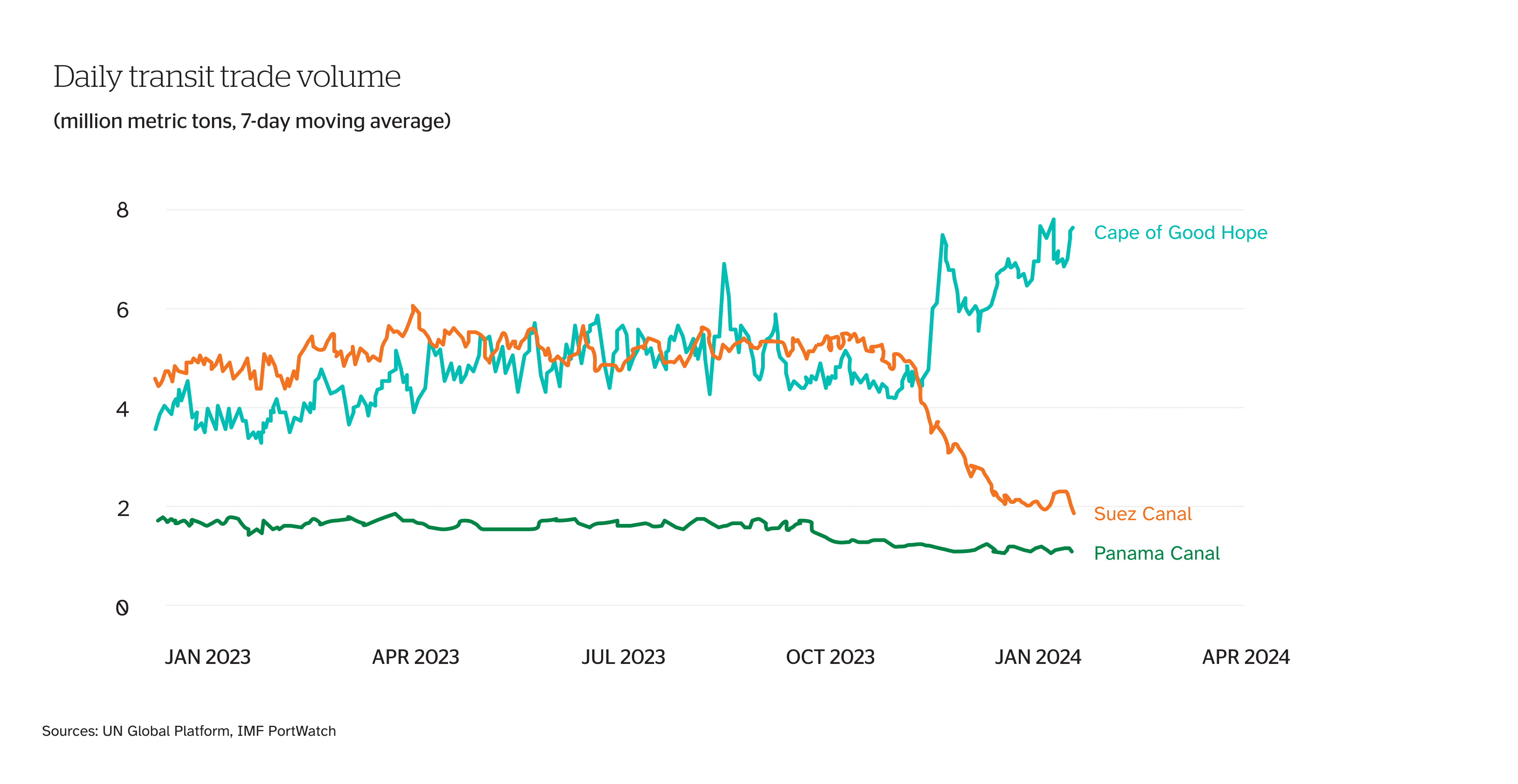

The closure of the Red Sea forced many vessels to bypass the Suez Canal and divert around the Cape of Good Hope, adding two to three weeks to their voyages^. The war in Ukraine and wider unrest in the Middle East have further disrupted traditional corridors.

With longer routes, restricted canal access and rougher conditions, vessels face greater exposure to heavy weather and a higher risk of cargo damage in transit.

With vessels spending longer at sea, containers are tied up for extended periods. To keep freight moving, shipping lines have reintroduced redundant equipment that would normally have been decommissioned. Many of these containers are in poor condition, with holes, faulty vents or worn seals.

These shifts are visible in NTI’s claims portfolio. Longer voyages, stressed equipment and port delays are driving higher rates of water, humidity and mould damage, particularly for retail cargo. Water damage claims, in particular, have increased by 20 per cent in 2025.

Temperature-controlled cargo has also been affected. Refrigerated containers pushed harder and serviced less often are failing more frequently, leading to a 15 per cent rise in temperature control claims.

Increased congestion has added another layer of pressure. In Sydney, port dwell times have grown by up to 30 per cent, while one NTI customer in Melbourne had 30 refrigerated containers stranded offshore for three weeks, leaving them unable to meet supermarket contracts despite the delay being beyond their control.

NTI’s role is not only to settle these claims, but to help prevent them. By analysing loss data and providing risk engineering support, NTI has guided customers toward practical solutions, from improved packaging design to better humidity controls.

One importer of industrial kitchen equipment, for example, halved its claim frequency after working with NTI risk engineers to redesign packaging and restraint systems suited to rougher sea conditions.

Targeted in transit

Cargo theft has escalated in both scale and sophistication. With hotspots emerging in North America and Southeast Asia, NTI saw a 10 per cent increase in theft claims from 2024 to 2025.

What was once opportunistic pilfering is now driven by organised groups that track shipments and time their thefts to exploit weak points in the supply chain.

Nearly every NTI claim involving imports from the US over the past two years has involved theft, non-delivery or unexplained loss. Theft has become a regular feature of inland transport legs, in particular – containers moving by rail and road are broken into, part of the load is removed, and the doors are resealed, leaving the loss undetected until the cargo reaches Australia.

Around major Asian ports such as Singapore and Manila, delays and interference – from cyber tampering to poor handling infrastructure – have created further opportunities for theft.

In Australia, car theft has surged. NTI’s carrier theft claims are up around 40 per cent on last year, and stolen vehicles account for nearly a third of these, with organised groups seeking high-value models and spare parts.

Operators have responded by hardening their sites and tightening access to information. From bollards, alarms and CCTV to 24-hour on-site staff, stricter key management and trusted-staff policies, businesses are going to extraordinary lengths to protect their fleets. Even so, the sophistication of organised crime means theft remains a persistent risk.

NTI uses its claims data and risk engineering expertise to help customers understand where custody chains are most vulnerable and suggest practical improvements. And while recoveries in theft cases are complex, NTI’s dedicated in-house team pursues responsible parties wherever possible to help contain costs and protect premiums.

Building resilience in a disrupted world

If the past five years have shown anything, it’s that disruption is no longer measured in short-term shocks – it’s now a permanent feature of global trade.

For retailers, the response has been to diversify supply chains, hold more buffer stock, and invest in packaging and site security that can withstand tougher conditions. Those steps don’t eliminate risk, but they do make businesses more resilient when the unexpected happens.

NTI’s role is to turn claims expertise into practical guidance. By analysing thousands of cases, our marine specialists identify recurring patterns of loss and share proven strategies that help customers strengthen their operations, from packaging and equipment choices to supply chain planning.

With conflicts, theft, congestion and rerouted trade all reshaping the way goods move, supply chains will continue to face challenges. But the adaptability of the logistics industry, backed by insights and support from experienced partners, remains its greatest strength.

For brokers and their clients, the focus now is not just on weathering the next disruption, but on building the resilience to keep goods moving, no matter what comes next^.

*Sea-Intelligence, Global Liner Performance (GLP) Report Issue 161, 2025

^International Monetary Fund (IMF), Red Sea Attacks Disrupt Global Trade, 2024

This article contains general information only and does not take into account your objectives, financial situation or needs. You should obtain professional advice based on relevant personal circumstances. Our products are subject to limits and exclusions. NTI is not responsible or liable for your use or reliance on the information in this article. Insurance products are provided by National Transport Insurance, a joint venture of the insurers CGU Australia Pty Ltd trading as CGU Insurance ABN 62 004 478 960 AFSL 700014 and AAI Limited Trading as Vero Insurance ABN 48 005 297 807 AFSL 230859 each holding a 50% share. National Transport Insurance is administered on behalf of the insurers by its manager NTI Limited ABN 84 000 746 109 AFSL 237246