We've created a helpful downloadable resource summarising this information.

Marine insurance plays a significant role for many Australian industries including Transport and Logistics, but it’s not always well understood.

There are multiple products which fall within Marine insurance, from covers for the movement of goods and the parties responsible for them along the way, to coverage for vessels, to liability cover for businesses operating in maritime professions and trades.

This guide aims to clarify the most common areas of confusion around Marine insurance and make it simpler for you to understand when clients require Marine insurance and how to ensure they are adequately covered.

Marine Exposures - More common than you think

“Many Australian businesses have an exposure which could be protected by a Marine insurance policy.”

Whether buying, selling, trading, transporting, building/repairing, anything physical (and some intangible risks too!), marine risks are a part of most businesses.

From big international companies to your local tradie, there can be a marine exposure. And chances are there’s also a marine policy to fit the client’s requirements.

Exposures and Activities Covered by NTI’s Marine Insurance products

Marine Insurance Policy | Exposures |

Cargo Insurance |

|

Carriers Insurance |

|

Marine Liability

|

|

Commercial Hull |

|

Cargo or Carriers Insurance?

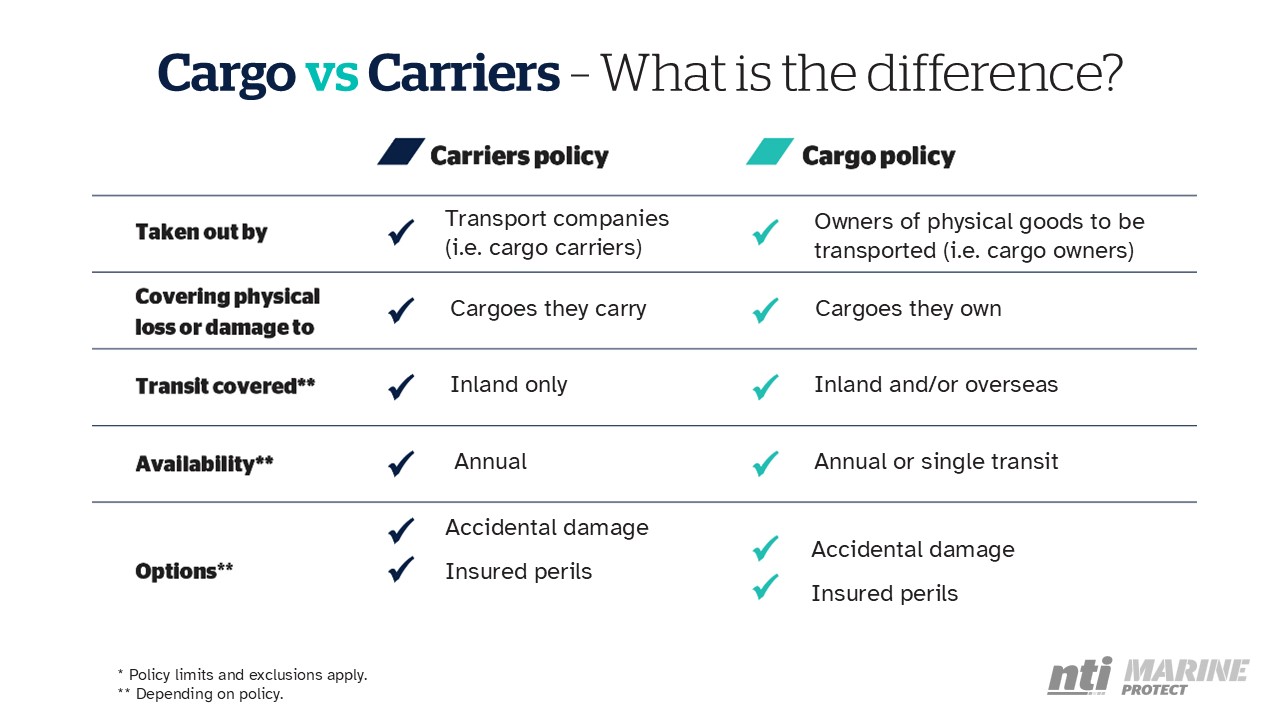

By far the most common Marine insurance question we hear is – ‘Does my client need Cargo or Carriers insurance?’

A Cargo policy is taken out by the owner of the cargo (the insured) in their name to protect their goods in transit - exported from, imported to and in transit within Australia by sea, air, road and/or rail.

A Carriers policy is designed to cover transport and logistics operators for their responsibility or contractual liability to the owner of the cargo they are transporting for loss or damage i.e. to protect themselves from claims made by the owner of the goods.

Carriers Insurance, Consolidate Cover to Reduce Potential Gaps for transport & logistics customers

Cover can be complex and when there’s multiple parties and assets involved, gaps in cover can be a significant risk. Knowing when a client could consolidate multiple policies with one insurer may help to close gaps in cover and deliver a better outcome. That’s why NTI’s products are designed to work together.

Our claims team can efficiently coordinate the management of a single claim that crosses multiple areas of coverage across NTI policies. This avoids the inefficiencies and occasional conflicts that can arise when different insurers are involved in the same claim – particularly when things get complicated.

Example 1 – Large National Transport Fleet

Multiple standalone NTI policies to cover many of the risks involved in transporting goods, including Marine Carriers insurance.

NTI Fleet NTI Carriers Insurance NTI Liability Insurance

| Example 2 – SME Local Transport Business

NTI Transport Pack policy with multiple options placed to cover their operations transporting goods on behalf of customers.

NTI Transport Pack

|

Cargo Insurance, Know Your Incoterms

Broadly speaking, Incoterms (International Commercial Terms) are globally recognised rules that outline who is responsible, buyer or seller, for goods at different parts of the shipping journey. For example, who is responsible when goods are being unloaded or loaded at a port?

More specifically Incoterms:

- Define responsibilities for buyers and sellers in a global transaction.

- Outline the costs and risks allocated to the buyer and the seller.

- Provide a global language for ensuring a smooth trade transaction.

- Establish risk transfer for insurance purposes.

- Are expressed as 11 different terms with corresponding three-letter acronyms.

Example: Two Common Incoterms

FOB – Free on Board: Risk/ownership transfers from Seller to Buyer once the freight is on the conveying vessel. Buyers have greater control over logistics/shipping costs and methods.

CIF – Cost Insurance and Freight: The Seller covers the costs, insurance, and freight of a Buyer’s order while in transit. Once goods reach the buyer's port of destination the buyer assumes costs and liabilities for unloading and delivering the shipment to the destination. Control and risks related to insurance coverage differ significantly depending on whether clients are importing or exporting.

Not sure where to start? Get in Touch!

Many brokers leverage NTI’s Marine Insurance expertise to ensure their customers are adequately covered. If your expertise isn’t in Marine Insurance

- Understand your customer’s needs, bearing in mind they may not realise that they need marine insurance. For example, our Transport Pack and Motor Fleet customers often have cross over with marine insurance:

a. Is the customer being paid to move goods and wants to be covered in the event of loss or damage? (Carriers)

b. Is the customer sending and/or receiving and/or purchasing goods that they need insured? (Cargo)

c. Option for Hull

d. Option for Liability

- Contact your NTI Representative to discuss what coverage is needed, how it might be tailored to your customer’s needs and how best to transact and manage polices.

- Visit the NTI website, and access the Broker Hub for more resources, documents and information on Marine insurance.